How Much are Tax Professionals Paid in Today’s Market?

As many tax people round the corner to the final big push of another tax year, I find myself very busy – struggling to carve out time for this month’s newsletter. Although you can’t help but hear about an economic slowdown or recession that is coming (or is it here?); someone needs to tell the labor market that’s where we are at. In fact, some say that it is a key factor in why the Fed continues to bump rates. They can’t seem to get their arms around the labor shortage and wage increases that come with it. All of this brings me to the topic of this newsletter. Wages. What are tax professionals earning in the market today?

As I always do when I put out a salary newsletter, I need to make this disclaimer. Trying to assign a salary range to a particular title or years of experience, is like ….. There are a lot of variables that determine what someone should get paid or will get paid. There’s the obvious – years of experience, education, credentials, specialization, geographic location, etc.; but there are other factors we don’t often think about. Factors such as time of year, industry, a company and an individual’s performance, a person’s confidence, the size and reputation of the organization they work for, and many others.

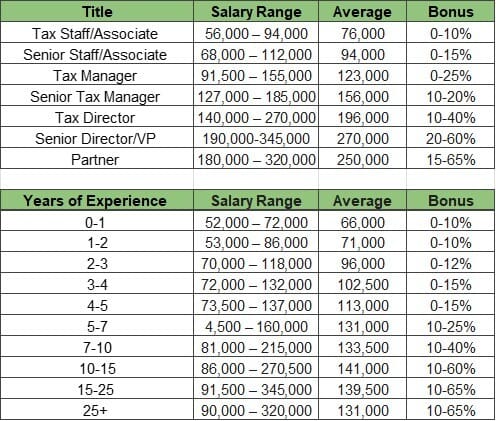

What I try to do with this spreadsheet is give you a picture of what we are seeing in the market as of now. Now being the last few months. These numbers are for income tax professionals and are an average of what we see in both public accounting and industry. They represent people with a more general skillset. These numbers do include some people with an international and state income tax, or planning background; although these tax professionals may have the capacity to earn more given their specialization.

A couple of things I want to point out: these numbers are weighted averages with outliers removed from the calculations and title doesn’t always equate to years of experience. I think it’s interesting that salaries can taper off a bit as someone gets to the later part of their career and that you start to see the salary range widen after people are a few years into their career.

I’m sure I’ll get some calls and emails because of this information. Please remember, I’m just the messenger. I just accumulate the data, which is already available to the public. Please also remember that money isn’t the only factor to consider when looking for a job or deciding whether to make a change. Just like a company has a hard time putting a value on an employee that will always go the extra mile, it’s hard to put a value on a boss that is reasonable in their expectations or an organization that encourages learning and growth.

If you have a specific situation you want input on, please reach out to me or one of the recruiters in the office. Although I didn’t include indirect tax salaries in these numbers, I have that information because they represent about 25% of the work we do. In next month’s newsletter I plan to opine on the in-person, hybrid and WFH issue. I hear all sides of this issue from different stakeholders. Until then, may your charge hours be many and your review notes well received.

To your continued success,

Jay

Jay McCauley

Executive Recruiter, Oxford Tax Recruiting

[email protected]

www.oxfordtaxrecruiting.com

(303) 730-0100